Manufacturers for the alcohol beverages market continue pushing forward, developing novel ingredients and improving existing ones, but their progress can’t help but be eclipsed by international events—namely, the business interruptions caused by response to the COVID-19 pandemic.

There is, at least for the next year or so, no more business as usual, and ingredients purveyors are feeling it as the pandemic and stay-at-home orders continue shaping trends in the ingredient space.

Rob Wilson, managing director/partner, consumer products and retail, L.E.K. Consulting

“The main thing going on in the industry right now is that it’s facing serious headwinds,” says Rob Wilson, managing director/partner, consumer products and retail sector, L.E.K. Consulting in Chicago. “COVID was a body slam on an industry already facing challenges.

“Craft brewers are in crisis mode,” he continues. “Some aren’t going to make it.”

Wilson says on-premise sales typically help brewers court and cultivate loyal customers. The problem is, most are carrying great amounts of debt. They simply don’t have sufficient liquid assets to weather the downturn. “It’s tough right now.”

Initially, industry observers anticipated alcoholic beverage sales would fall based on social distancing and other shifts in consumer purchasing; however, “alcohol as a segment in the United States and Canada has been remarkably resilient,” says Stuart Sands, general manager of Country Malt Group in North America. “Consumers have demonstrated that beverage alcohol continues to be an important part of their lives.”

Sands observed a “moderate drop” in beer production volume in April and May, but consumer consumption has quickly shifted from on-premise to off-premise sales. “In the craft beer space, this change has rippled through the ingredient supply chain, with volumes shifting towards brewers with established small-pack distribution in place. Some of these brewers are seeing record growth, while brewpubs and taprooms have seen declines in volume. As a result, many of these on-premise businesses began pivoting quickly to ‘to-go’ sales of cans, growlers, and bottles,” he says.

“The big trend in the COVID world is just value. More value,” adds Wilson.

And volume. According to Wilson, sales of 3-liter boxed wine are up 53 percent year over year, ending March 14. Sales of 24-pack beer picked up 24 percent for that same period.

David Douglas, senior director, science and technical division, ATPGroup [Photo courtesy ATP]

“While these changes have kept ingredient suppliers on their toes, the overall supply chain of malt, hops, and other ingredients remains flexible and robust. Beverage alcohol producers continue to have good access to supplies,” says Sands. “While the supply of ingredients remains strong, the freight side of the supply chain is under pressure, especially into COVID-19 hotspots.”

Transportation, including carrier and transborder freight and customs clearance, has created challenges, as have changes in business hours at customer sites. This has caused manufacturers to experience an increase in missed delivery appointments. And because it’s happening across industries, it’s complicating supply chain logistics, says Sands.

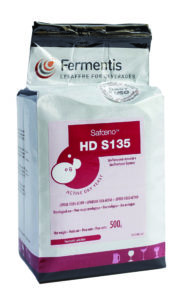

Fermentis Safoeno HD S135 Yeast [Photo courtesy ATP Group]

The company has been placing an emphasis on effective pre-planning with its suppliers and clients, says Douglas. “This is the most critical factor we’ve been emphasizing with our clients, especially in the wine industry as harvest approaches,” he continues. The move has helped both the company and its clients “avoid significant interruptions or delays.”

Pre-COVID, Wilson says, his firm was seeing increased interest in local sourcing, which has now become critical to many brewery operations. Beer makers are now seeking local grains, hops, and fruits “for more important reasons we did not foresee: supply chain.”

What’ll You Have?

A spoonful of pure malt [Photo courtesy Gusmer]

In 2020, craft brewers have continued to focus on more healthful, lower calorie, lower carb beer, says Wilson, as well as those with more functional ingredients. There’s also increased interest in gluten-free ingredients. He cites Sufferfest’s product line and Dogfish Head’s SeaQuench Ale as examples.

Wilson further explains that a subset of consumers is seeking products made with so-called ancient grains. In response, some brewers are experimenting with quinoa, millet, and cassava—a trend that originated pre-COVID.

Canned cocktails and hard seltzers are popular beverages driving flavoring demand, according to Al Murphy, vice president of Mother Murphy’s Flavors, based in Greensboro, N.C. “Companies are requesting common flavors such as citrus—lime, grapefruit, and lemon—for new seltzer brands,” he says. “Another group is focusing on cocktail flavors for canned cocktails as well. They’re more interested in Old Fashioned, Manhattan, Moscow Mule, or other popular cocktails in a RTD [ready to drink] form.”

to Al Murphy, vice president of Mother Murphy’s Flavors

In the yeast category, “one of the most exciting new innovations is the E2U [Easy to Use] program being introduced by our supply partner, Fermentis,” says ATPGroup’s Douglas. Fermentis’ specialized production process results in dry yeast with maximum viability at inoculation.

“The end result for the winemaker is that the laborious, time consuming, and complex process of rehydration has been eliminated. Winemakers can simply add the yeast to the tanks and mix.”

The concept extends into other specialty ingredients, including yeast nutrients. These, says Douglas, “are produced in liquid form for maximum integration and effect, and the dry nutrients are manufactured for minimal dust and easy dispersion.”

Another option for craft brewers is the PureMalt Products Crafted Range, which consists of six different brewed concentrates. These products, according to Mike Miziorko, product manager, brewing technology, Gusmer Enterprises, Inc., which has three locations in California, are “designed to help craft brewers augment beers with various all-natural flavor and/or color attributes. All of the PureMalt Products are brewed with the finest Scottish malted barley, water, hops, and yeast; after fermentation, they’re filtered and then gently concentrated into the final products.”

A brewer can add a little to make a subtle color change, while higher concentrations can be used to transform color or flavor. Miziorko says the product is cost effective and can be used “for color adjustment, distinct color hues, and flavor profiles for brand creation through late addition to beer. There are also pale concentrates for enhancing or restoring body, foam, and mouthfeel in beer.”

Miziorko adds, “In our current situation, where many brewers find themselves with an excess of inventory, PureMalt products can help to creatively diversify draft beer assortment or to fine-tune the color, flavor, and body of beers already in fermenters, brite tanks, or kegs.”

Situation Normal or Temporarily Challenging?

Some of the changes necessitated as a result of COVID-19 should prove temporary. Required supply chain adjustments based on disruptions, for example, are “a temporary phenomenon,” says Wilson. Some producers sourcing ingredients outside North America, for example, have needed to extend their forecast windows by three or more months. Other issues have not been as trivial. These include tight yeast supplies, can shortages, and other packaging-related issues, according to Wilson.

These conditions have warranted changes in operations. Sands has seen gaps in North American yeast supplies. “Brewers and distillers have reacted to this situation by increasing their re-pitching of yeast, using other suppliers, and taking alternate package sizes of yeast,” he says.

As for the flavoring supply chain, Murphy says availability “depends on the ingredient and the geographical area where the ingredient is sourced. We source thousands of raw materials and have seen some supply chain disruptions for certain ingredients. But overall, we haven’t had much of a disruption.” Any ingredient availability interruptions, he says, should be temporary.

StuartSands, general manager, Country Malt Group [Photo courtesy CMG]

Liquid malt extract sales continue to be healthy, says Sands. The ingredient is used as a natural colorant, dough improver, and sweetener in clean label applications. In the current economic climate, as has been the pattern historically in periods of financial hardship, “we see increases in homebrewing and winemaking as consumers look to both take up a hobby and potentially save money, while continuing to consume beer, spirits, and wine.” This has increased malt extract sales as well as sales of other homebrewing ingredients and supplies.

Murphy says his company has launched some manufacturing changes as a result of COVID-19. “We’ve been implementing new policies within our facility and have staggered our employees’ schedules,” he says. This includes creating several different shifts within the facility to ensure proper social distancing and temporarily eliminating customer visits. “Anyone who sets foot on the shipping dock will have their temperature taken and we are doing routine temperature checks within our facility.”

Forecasts Favor Functional Ingredients

Experimental malt created in the Great Western Malting Malt Innovation Center is test brewed in the onsite pilot-brewery system [Photo courtesy GWM]

Although there will be a return to product launches in the future, the focus for ingredients producers right now still tends to be on navigating day-to-day operational tasks.

Sands says that, in the alcoholic beverages space, manufacturers will “continue to look for ways to leverage digital assets to simplify their businesses. Online ordering, automated ingredient supply planning, sharing of food safety and analysis information, improvements in digital [purchase order] transactions, transparency in delivery, invoicing, and credit management are all items craft beverage manufacturers will look for in the coming years.”

Organizations including the United States Department of Agriculture (USDA) and Canadian Food Inspection Agency (CFIA), says Sands, “are beginning to look more closely at food safety at beverage manufacturing sites.

“We’re ready to partner with our customers in facing these requirements and challenges head-on,” he says. “We believe that the future remains bright.”